Free zone Company Setup – Free zones in UAE are a boon for foreign entrepreneurs/investors. These are economic areas developed to boost international businesses. Foreign companies have the privilege to retain complete ownership and are not liable to pay any tax or customs duty.

At present, there are 45 free zones located in different parts of the UAE. These zones are industry-specific and do not promote only one sector. For example, Dubai Healthcare City serves those in the healthcare industry, while Jebel Ali free zone is directly linked to the largest port in the region and favored by those in the import-export trade. You should select a free zone according to the nature of your business. Licenses, legislation, capital requisites and so on are specific to a free zone. Besides, free zones in the UAE have always proved to be beneficial for foreign investors.

Why establish your venture in a free zone?

Zero tax and custom duty

As mentioned above, foreign companies within free zones are not subjected to any tax or customs duty i.e. 0% corporate and personal tax, no import or export tax, plus exemption from VAT, currently at 5%.

Fast and easy setup

The process of organizing a business in a free zone is straightforward. Hence will not take more than 15 days for the complete establishment. But, the process differs according to your business activity. Most of the free zones ask for a few elementary documents, such as passport copies and business plan. Free zones do offer various desk and virtual packages with the liberty to access addresses and other facilities in an adhoc manner.

Sole proprietorship

Non-native entrepreneurs desiring to set up a business in mainland UAE should enter a partnership with natives. But, foreign ventures in free zones are free from these obligations and have the authority to hold 100% ownership.

Easy logistics and trading within the UAE

There are restrictions for a free zone company to trade within the UAE market. But, you can resolve this by working with a local distributor for a fee that will dispense the goods into the market. Another way would be setting up branches of your business across the UAE at a later date. These branches will help in marketing the goods within the UAE mainland.

Excellent support and assistance

Apart from tax exemption, free zones offer excellent aid in business setup and beyond. Free zones provide complete aid with the banking process and also recommend the best banks for your business. These zones also support you with the visa process for both shareholders and any applicable dependents. Besides, free zones also offer business advice and networking services for an ongoing business. You can always rely on free zones to access startup hubs and growth initiatives for the smooth functioning of your business.

Privacy protection

Free zones are well known for their privacy standards. Company information such as ownership, shareholder’s details, and other classified information is never made public. The nature of business plays a significant role in selecting a free zone. Some principle free zones and their license activities include:

Jebel Ali Free Zone (JAFZA) – Logistics, trade, storage unit, production houses;

Dubai Multi Commodities Centre (DMCC) – Trading, General Trading, Commodities Trade and Exchanges;

Dubai Healthcare City (DHCC) – Healthcare, medical education, pharmaceuticals, medical equipment;

Dubai International Finance Centre (DIFC) – Financial services, Banking;

Dubai Knowledge Park (DKP) – Human resource management, training, and development;

Dubai South (DSF) – Aviation, Ancillary services, logistics, light industry;

Dubai Internet City (DIC) – Internet, communication technology;

Dubai Trade Centre (DWC) – Trading, General Trading, Consulting Services;

Dubai Silicon Oasis (DSO) – Telecom, information technology, electronic engineering;

Fujairah Creative City (FCC) – E-Commerce, Media, communication, consulting, technology;

Fujairah Free Zone- (FZZ) – Oil & Gas Trading and consulting, logistics, trading;

Ajman Free Zone (AFZA) – Trading, E-commerce, offshore, industry;

Sharjah Airport International (SAIF ZONE) – Trading, General Trading, Service, Logistics and Industrial.

Abu Dhabi Free Zone (KIZAD) – Manufacturing, Logistics and services;

Abu Dhabi Twofour54 – Media related activities;

Free zone corporate entities are of two types

1. Free zone establishment (FZE)

2. Free Zone Company (FZC)

Both entities operate the same but differ in the number of shareholders. ‘Establishment’ has room for a single shareholder, whereas ‘Company’ should have at least two shareholders. To be specific, FZC is a limited liability company.

The Privileges of setting up a Free Zone/Offshore company in the UAE:

– 100% ownership for investors, regardless of their nationality and country of origin.

– 100% tax exemption on personal or corporate income or gains.

– 100% repatriation of capital and profits.

– Obtaining a UAE residency Visa.

– Privacy and confidentiality in disclosing the names of the shareholders to the public.

– Having a bank account in a very reputable bank.

– Exclusion from all import and export duties.

– Handy office and warehouse facilities.

– Option for a company set up by an individual.

– Complete secrecy of operations.

– Flexibility to engage in international business.

– Fewer renewal charges.

– Flexibility to hold properties.

– The option of liquidating anytime.

– Assistance in housing facilities, staff visas, and other support services.

New company model launched by Abu Dhabi Global Market (ADGM

ADGM’s SPV (Special Purpose Vehicle) regime caters to a broad range of business types, uses and industry sectors. These include corporates, sovereign wealth funds, subsidiary undertaking of a body corporate that is incorporated by federal law or by a law of any Emirate in the UAE, ADGM single family offices, trustees and individual investors.

The role of SPVs

SPVs are corporate vehicles, typically private companies, established for the purpose of isolating financial and legal risk by ring-fencing assets and liabilities. SPVs can be established as subsidiaries, project or joint venture vehicles to ensure that only those assets linked to a related transaction are exposed to the liabilities associated with that transaction. As the key feature of an SPV is its separate legal personality, claims by the SPV’s creditors cannot be attached to the assets of the SPV’s shareholders or any of its sister companies.

The ADGM SPV regime has been designed to be flexible, robust, simple and efficient. It offers a quick, easyto-use and fully digital registration process. Its straightforward ongoing reporting requirements and a costeffective and transparent fee structure makes ADGM a preferred jurisdiction choice for those office address. As a result an ADGM SPV may benefit from the use of a registered office address provided by company service provider.

ADGM practices a thorough yet efficient due diligence process whilst valuing transparency for clients that meet certain criteria, ADGM also provides the option of the discreet ‘Restricted Scope Company’ SPV where public disclosure is limited. This is subject to the Registrar’s approval. ADGM offers a platform from which to fulfil narrow, specific or temporary corporate objectives. ADGM SPVs are organized to the ADGM Companies Regulations 2015. This offers consistency across ADGM’s corporate vehicles. SPVs are granted a commercial license specifying that the company is undertaking Special Purpose Vehicle activities.

• ADGM SPV Types.

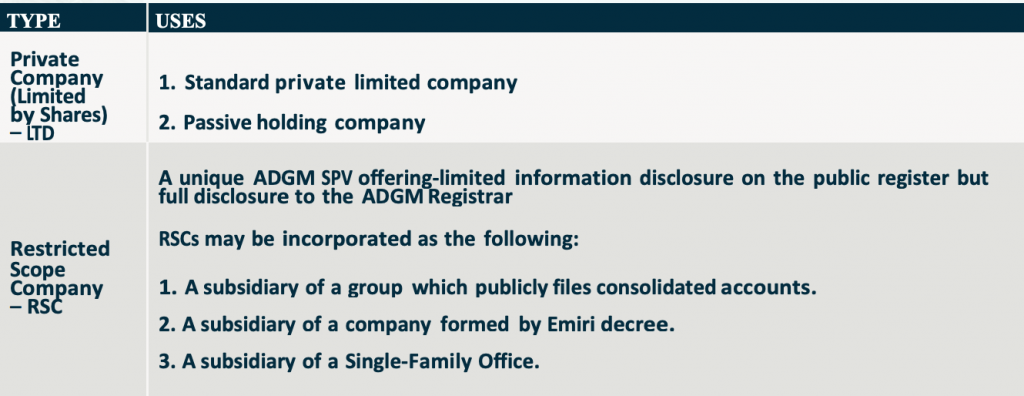

The ADGM Companies Regulations framework provides the following types:

• Typical Uses for SPVs.

– Securitization.

Can be used by an originating party to securities loans (or other receivables) by creating an SPV which purchases these assets by issuing debt, secured on these underlying assets. This ensures that the holders of the asset-backed securities have first priority right to receive payments on the debt while limiting recourse to the originator of the assets.

– Real Estate Investment.

Can be used to acquire title to real property and limit recourse of mortgage lenders depending on the location of the asset. In some jurisdictions the sale of the SPV’s shares can result in lower taxes and transaction fees when compared to transferring the asset.

– Financing.

Can be used to ring-fence investments, permitting financing without increasing debt levels for the parent company or exposing the parent’s assets (or SPV’s assets) to cross-liabilities.

– Asset Transfer.

Can be used to transfer assets along with associated material agreements which may permit the transfer of all or part of ownership of the enterprise while keeping intact material agreements which may be necessary to maintain the value of the asset.

– Risk Sharing.

Can be used to form project companies for joint ventures, reflecting agreed management responsibility while legally isolating joint venture partners from risks associated with the venture.

– Raising Capital.

Can be used to raise capital at favorable rates in certain situations, with credit worthiness determined by the available collateral of the SPV, rather than the credit rating of the parent company.

– Intellectual Property.

Can be used to separate valuable IP into a standalone SPV which has minimal liabilities and can be used to raise funds and enter into license agreements with third parties. Also, a useful tool to manage products with a variety of IP components.

We hope that these overviews would gain your satisfaction. Should you have any questions, please don’t hesitate to contact BridgePoint Law at any time.

Wassim Alkudmani: wk@bplegalfirm.com

Samer Kodmani: sam@bplegalfirm.com